Global Metalworking Tools Market Overview

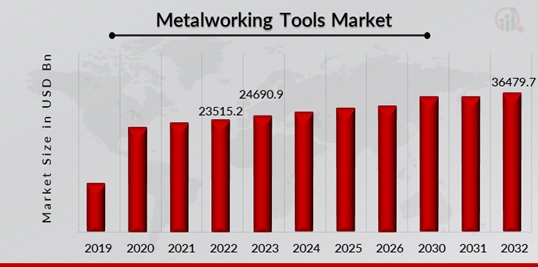

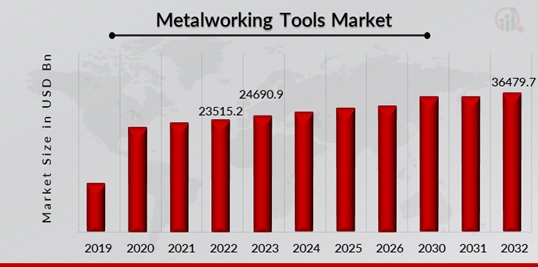

Metalworking Tools Market Size was valued at USD 23515.2 Billion in 2022. The Metalworking Tools Market industry is projected to grow from USD 24690.9 Billion in 2023 to USD 36479.7 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.00% during the forecast period (2024 - 2032). Technological advancements and expanded manufacturing capacity are the key market drivers enhancing market growth.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Metalworking Tools Market Trends

-

Growing usage of Industry 4.0 is driving market growth

The increased usage of Industry 4.0 is driving Market CAGR for Metalworking Tools. The introduction of Business 4.0 has had a considerable impact on the metal cutting business. Industry 4.0 adoption in the metal cutting sector has prompted the development of intelligent cutting tools that can communicate with other machines, collect data, and make modifications to improve performance. These systems can monitor the cutting process in real time and adjust the speed, feed, and other variables to optimize cutting. This leads to increased production, less waste, and better accuracy. Manufacturers may now use data analytics to identify trends, patterns, and anomalies in their manufacturing processes, thanks to Industry 4.0. This helps manufacturers streamline their procedures and identify potential improvement areas. Predictive analytics can also help producers anticipate the need for maintenance, reduce downtime and increase productivity. Additionally, quality control, which is intimately related to the tools used in manufacturing, is critical. Real-time quality assurance is now achievable thanks to the use of Industry 4.0 technologies and an Automated Virtual Metrology (AVM) system. Real-time quality assurance is expected to increase the market penetration of metal cutting tools.

Moreover, metal forming is extremely important in the automotive, aerospace, and defense industries. The majority of mass-produced passenger cars are built of metal. They are the primary raw materials utilized in these industries because they can be easily changed and shaped into shapes that meet the application requirements. Furthermore, firms that build airplanes use specific high-strength, lightweight metals to create aircraft components and bodies. Because of the emphasis on safety, even the smallest manufactured metal parts used to build aerospace components must have a high tolerance and adhere to demanding quality standards. However, all metal parts used in airplanes must be sturdy and able to survive the pressure and temperature variations that occur during flight. Investments in the automobile, aerospace, and defense industries have increased demand. All of these factors will contribute to the market's steady rise over the forecast period.

Another major development in the cutting tool market is the increased usage of complex materials such as ceramics, polycrystalline diamond (PCD), and cubic boron nitride (CBN). These materials are harder, more wear resistant, and temperature stable than typical tools such as high-speed steel (HSS) and carbide. The need for new materials stems from their ability to improve cutting tool performance, extend tool life, and reduce machining costs. Cutting tools made from cutting-edge materials enable vehicle manufacturers to efficiently machine high-strength materials such as composites and titanium. Similar to this, the aerospace industry uses cutting tools made of cutting-edge materials to make complex components at faster machining rates and with more precision. This, in turn, drives the Metalworking Tools market revenue.

Metalworking Tools Market Segment Insights

-

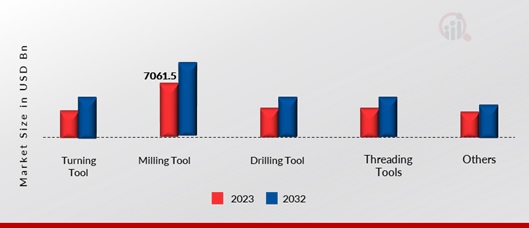

Metalworking Tools Product Type Insights

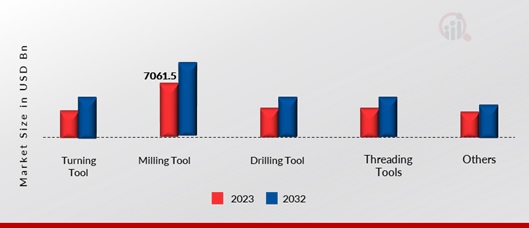

The Metalworking Tools Market segmentation, based on Product Type, includes turning tool, milling tool, drilling tool, threading tools and others. The milling tool segment has the largest market share, accounting for 28.6% during the projection period. These are commonly referred to as milling cutters and are used in milling machines for milling purposes. Milling cutters are classified into four types: slitting cutters, milling cutters, end mills, and gear cutters. They are all utilized for a variety of applications. Milling tools will be in higher demand over the projected period because of their high speed and affordability in increasing productivity for machine shops of all sizes. Even manufacturers of specialist products, such as those who complete dies and molds or utilize HSM to create EDM electrodes, have discovered that this machining method lowers production costs, improves quality, and shortens production times.

Figure 1: Metalworking Tools Market by Product Type, 2023 & 2030 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Metalworking Tools End Users/Applications Insights

The Metalworking Tools Market segmentation, based on End Users/Applications, includes automotive, machinery, electronics, chemical, railway & aerospace, medical and others. The automotive segment led the worldwide Metalworking Tools market in 2023. The creation and production of different automotive components for modern and high-end automobiles is a major factor driving the market's growth. The demand for efficient metal-cutting tools is increasing due to automobile components such as gearboxes, modern disc brakes, and clutch plates. Furthermore, increasing demand from a range of industries, including aerospace, construction, and food and beverage, is helping to drive up demand for industrial gear.

Metalworking Tools Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American Metalworking Tools Market area will dominate this market, accounting for 45.80%. This is because the country is implementing an increasing number of fabrication and construction projects, which is driving market growth. However, the market in Canada is rising due to increased investment from significant market participants in the country's metal cutting tool sector.

Further, the major countries studied in the market report are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: METALWORKING TOOLS MARKET SHARE BY REGION 2023 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe Metalworking Tools Market accounts for the second-largest market share. This expansion is due to Germany's expanding industrial and manufacturing sectors. Further, the German Metalworking Tools Market held the largest market share, and the UK Metalworking Tools Market was the fastest-growing market in the European region.

The Asia-Pacific Metalworking Tools Market is expected to grow at the fastest CAGR from 2024 to 2032. This is due to increased demand in industries such as construction, automotive, and food and beverage. Rising government backing for electric vehicles is also expected to drive industry expansion. Moreover, China’s Metalworking Tools Market held the largest market share, and the Indian Metalworking Tools Market was the fastest-growing market in the Asia-Pacific region.

Metalworking Tools Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Metalworking Tools market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Metalworking Tools industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Metalworking Tools industry to benefit clients and increase the market sector. In recent years, the Metalworking Tools industry has offered some of the most significant advantages to medicine. Major players in the Metalworking Tools market, including Mitsubishi Materials, Sandvik, OSG, Sumitomo Electric, Kyocera, IMC Group, Kennametal, Zhuzhou Cemented Carbide Group, Nachi-Fujikoshi, Shanghai Tool, YG-1, Union Tool, Ceratizit, Mapal, Korloy, Xiamen Jinlu, Tiangong, DIJET, LMT, Beijing Worldia Diamond Tools, Harbin Measuring & Cutting Tool.

Sandvik AB is a Swedish international engineering firm that manufactures and provides services for mining, rock excavation, drilling, rock processing (crushing and screening), metal cutting, and machining. The corporation was established in Gävleborg County, Sweden, in 1862. In 2022, it had roughly 40,500 employees and a revenue of 112 billion SEK from sales in approximately 150 countries. In March 2022, Sandvik Coromant announced the launch of the CoroDrill 860-PM, which provides greater performance in drilling operations while also enhancing tool durability and operational life.

Mitsubishi Materials Corporation is a Japanese corporation. It manufactures cement, copper and aluminum goods, cemented carbide tools, and electronic materials. It is one of Mitsubishi Group's core companies. The company is listed on the Tokyo Stock Exchange and the Osaka Securities Exchange. It is a constituent of the Nikkei 225 stock market index. In April 2022, Mitsubishi Materials Corporation Metalworking Solutions Company now offers two double-sided inserts: precision grade M class and wiper type.

Key Companies in the Metalworking Tools Market include

- Mitsubishi Materials

- Sandvik

- OSG

- Sumitomo Electric

- Kyocera

- IMC Group

- Kennametal

- Zhuzhou Cemented Carbide Group

- Nachi-Fujikoshi

- Shanghai Tool

- YG-1

- Union Tool

- Ceratizit

- Mapal

- Korloy

- Xiamen Jinlu

- Tiangong

- DIJET

- LMT

- Beijing Worldia Diamond Tools

- Harbin Measuring & Cutting Tool

Metalworking Tools Industry Developments

In August 2022, Sandvik acquired P. Rieger Werkzeugfabrik AG and Sphinx Tools Ltd, a precision solid round tool manufacturer based in Switzerland. Sandvik hopes that this acquisition will help to strengthen its position in the round-cutting tool market.

In June 2022, Milwaukee Tools revealed their cutting-edge wrecker with NITRUS CARBIDE SAWZALL Blad, which is ideal for remodeling and demolition jobs on construction sites and is engineered to function more effectively on a variety of metals.

Metalworking Tools Market Segmentation

Metalworking Tools Product Type Outlook

- Turning Tool

- Milling Tool

- Drilling Tool

- Threading Tools

- Others

Metalworking Tools End Users/Applications Outlook

- Automotive

- Machinery

- Electronics

- Chemical

- Railway & Aerospace

- Medical

- Others

Metalworking Tools Regional Outlook

- North America

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 23515.2 Billion |

| Market Size 2023 |

USD 24690.9 Billion |

| Market Size 2032 |

USD 36479.7 Billion |

| Compound Annual Growth Rate (CAGR) |

5.00% (2024-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2019-2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Product Type, End Users/Applications, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The US, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Mitsubishi Materials, Sandvik, OSG, Sumitomo Electric, Kyocera, IMC Group, Kennametal, Zhuzhou Cemented Carbide Group, Nachi-Fujikoshi, Shanghai Tool, YG-1, Union Tool, Ceratizit, Mapal, Korloy, Xiamen Jinlu, Tiangong, DIJET, LMT, Beijing Worldia Diamond Tools, Harbin Measuring & Cutting Tool. |

| Key Market Opportunities |

· Increasing demand for sophisticated and advanced tools and the growing marketing potential through the utilization of the latest technologies |

| Key Market Dynamics |

· Technological advancements |

Frequently Asked Questions (FAQ) :

The Metalworking Tools Market size was valued at USD 23515.2 Billion in 2023.

The global market is projected to grow at a CAGR of 5.00%% during the forecast period, 2024-2032.

North America had the largest share in the global market

The key players in the market are Mitsubishi Materials, Sandvik, OSG, Sumitomo Electric, Kyocera, IMC Group, Kennametal, Zhuzhou Cemented Carbide Group, Nachi-Fujikoshi, Shanghai Tool.

The automotive category dominated the market in 2023.

The milling tools had the largest share in the global market.